Sustainability Hurdles

Political volatility and uncertainty remains a major barrier to the sustainability strategies of big businesses around the world, and particularly in North America.

Today the Republican-controlled Congress continues to consider U.S. policies that would shift economic advantages to oil and gas production.

Coincidentally, today the U.S. Supreme Court rejected an appeal filed by oil and gas producer ExxonMobil to overturn a $14.25 million civil penalty imposed in December. Reuters described it as “the largest penalty ever assessed in a citizen-initiated lawsuit enforcing protections against air pollution under the landmark Clean Air Act environmental law.” The long-running case was filed by Environment Texas Citizen Lobby and the Sierra Club in 2010.

But Texas is more than home to Exxon Mobil’s Baytown Complex, America’s largest petroleum complex and site for which the U.S. Court of Appeals (5th District) awarded the record-breaking penalty. Indeed, as the latest “Electric Power Monthly” report from the U.S. Energy Information Administration shows, Texas is also the site of the largest utility-scale solar-powered electricity generation station to come online last month.

It makes one wonder what Texas Senators John Cornyn (R) and Ted Cruz (R) are thinking now about President Biden’s ‘all of the above’ energy strategy — which caused President Biden political pains — given what appears to be growing energy diversification in Texas, a state with significant energy problems and one really bad blackout in the winter of 2021.

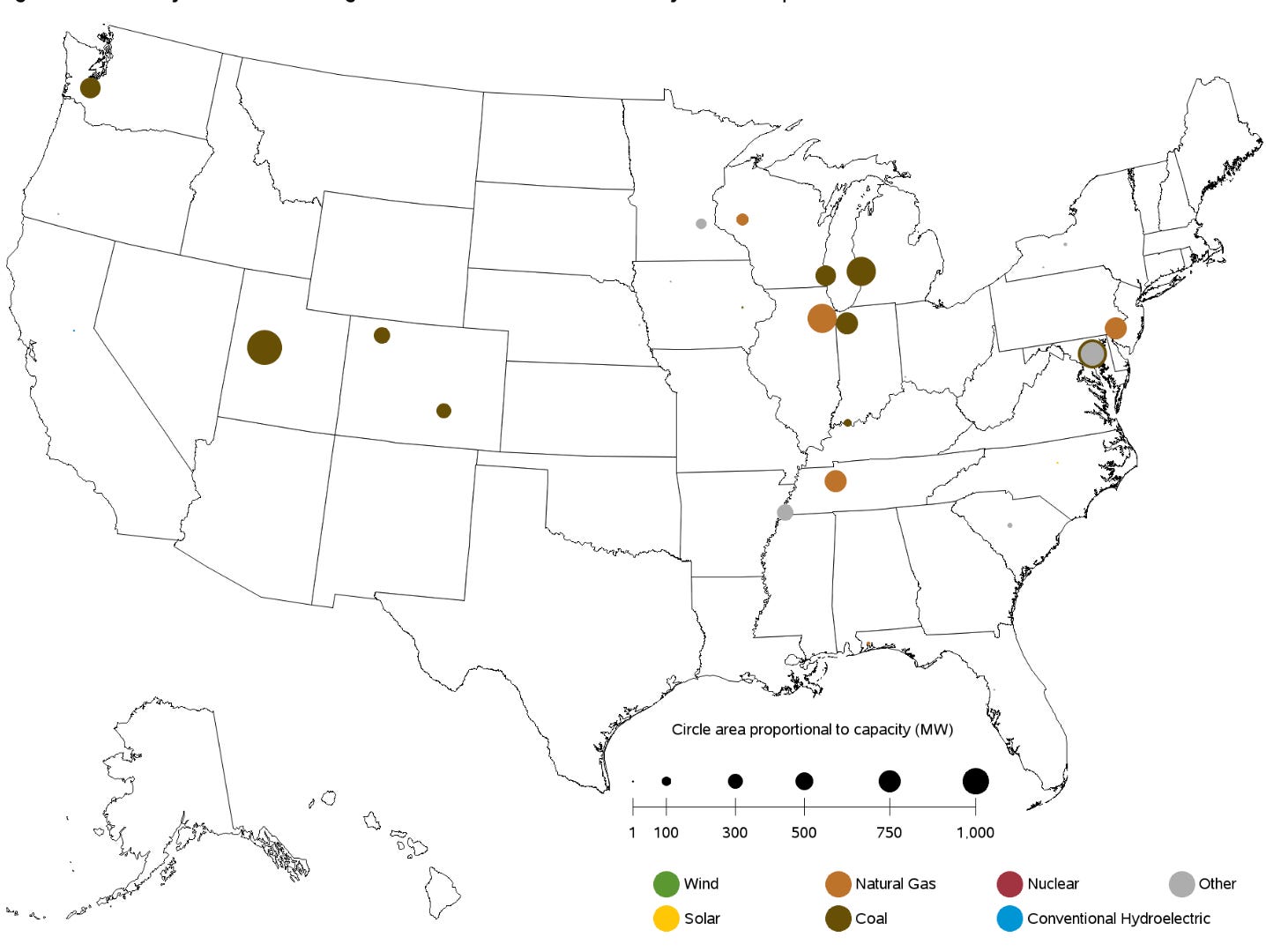

Nationwide, here’s what is planned to come online in the coming year.

And here’s what is planned on being shut down over the next year in the U.S..

To such sustainable concerns — including sustainable energy production in Texas — today the investing house Morgan Stanley released a Sustainable Signals survey with the opening line: “Globally, 88% of companies view sustainability as a potential driver of long-term value, and more than 80% say they can measure returns on investment for sustainability-related projects.”

Although the report does contain some interesting survey results (discussed further below), the aforementioned opening line is meaningless because “sustainability” itself isn’t uniformly defined (as has been discussed previously on SustainLab). So each of the 336 companies Morgan Stanley surveyed may have a different definition of the term. This fact is only mentioned in the disclosures section at the end of its 38-page report.

"ESG investments may also be referred to as Sustainable investments, impact aware investments, socially responsible investments or diversity, equity, and inclusion (“DEI”) investments. It is important to understand there are inconsistent ESG definitions and criteria within the industry, as well as multiple ESG ratings providers that provide ESG ratings of the same subject companies and/or securities that vary among the providers. This is due to a current lack of consistent global reporting and auditing standards as well as differences in definitions, methodologies, processes, data sources and subjectivity among ESG rating providers when determining a rating."

-- page 37, Morgan Stanley's Sustainable Signals, 2025, emphasis addedAnd no, this report is not a formal research report as defined by the Financial Industry Regulatory Authority (FINRA), the self-regulatory organization for member broker-dealers that is responsible under U.S. federal law for supervising member firms since the 1930s under oversight of the Securities and Exchange Commission (SEC).

Nevertheless, I highlight Morgan Stanley’s survey report because it does reasonably represent big business concerns about political volatility, uncertainty, and views about the risks of climate change. And by big business I mean these 336 businesses surveyed by Morgan Stanley had at least $100 million in annual revenue (termed “small”). About 40% of them reported at least $1 billion in annual revenue (“medium”). Another 40% reported at least $10 billion in annual revenue (“large”).

This is the second such annual survey by Morgan Stanley, whose own sustainability strategy “is focused on helping clients achieve their sustainability-related ambitions,” even as it withdrew without comment from the UN-sponsored Net Zero Banking Alliance (NZBA) in advance of President Trump’s inauguration in January. [Note: the NZBA is “a global member-led initiative supporting banks to lead on climate mitigation in line with the goals of the Paris Agreement.”] And in reporting on why Morgan Stanley and five other major U.S. banks withdrew from the NZBA, The Guardian’s environment correspondent Damien Gayle wrote that analysts believe the “withdrawals are an attempt to head off ‘anti-woke’ attacks from rightwing US politicians.”

But if “woke” includes climate mitigation, the annual report released today by Morgan Stanley suggests the vast majority of 118 major businesses they surveyed in North America are woke, with 23% of them reporting they are “already impacted” by climate change.

Given the concern by the majority of surveyed big businesses about the impacts of climate change as well as the short- medium- and long-term risks, it seems it is in their economic interests for the U.S. not to shift economic advantages to oil and gas production. That’s because such production results in more greenhouse gas emissions and hence, faster climate change, which climate scientists have long argued that “if global heating is allowed to continue then the world will rapidly reach a point beyond what can be adapted to.”

But unless large numbers of Americans contact their Senators to demand due consideration of the proposed legislation and amendments — so far there are over 280 amendments proposed by Republicans and Democrats alike — then it seems likely the Republican-controlled Congress will pass “TOBBA” (as I termed it previously for SustainLab) on an accelerated schedule without due consideration, like the U.S. House did, aiming for being done with the whole thing by July 4, the date the Trump Administration is pushing for.

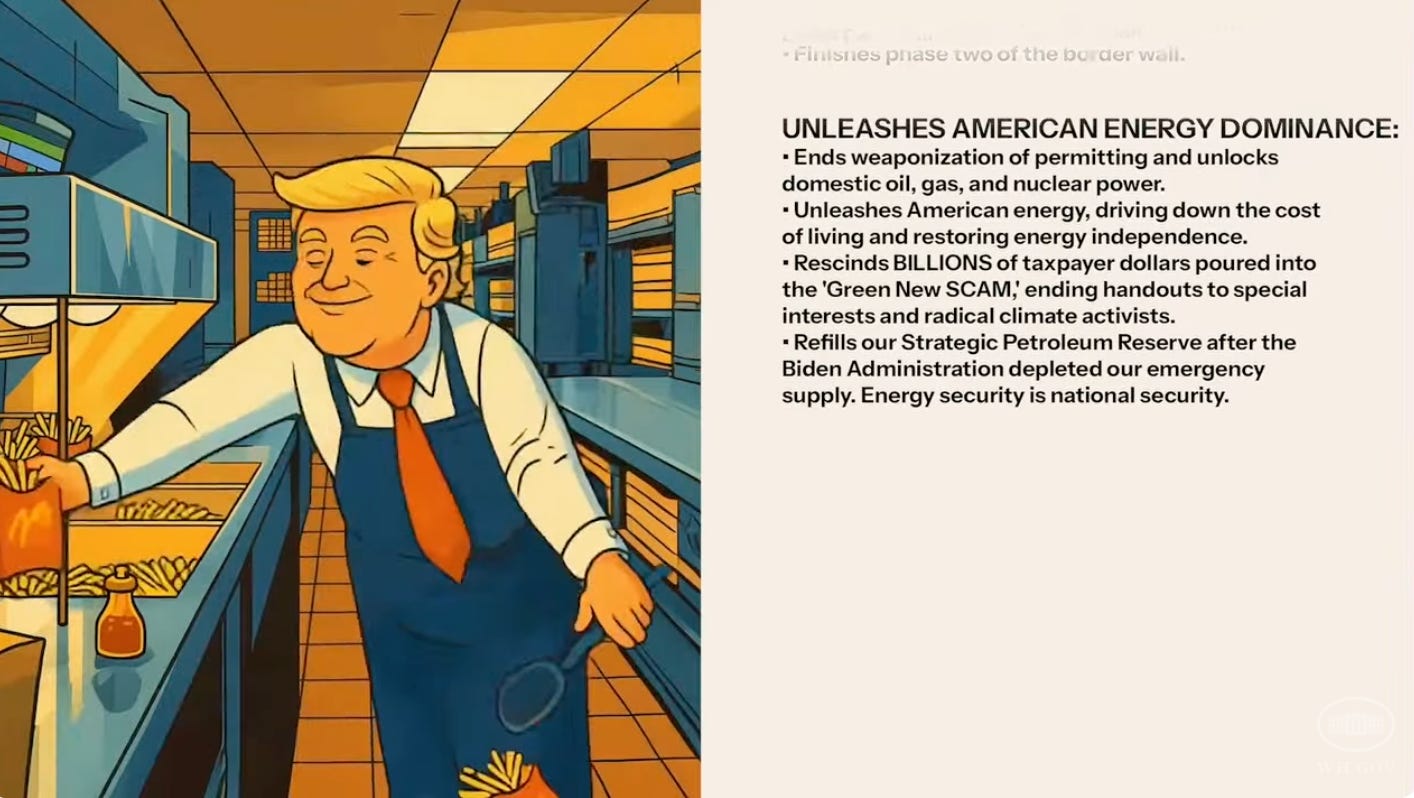

Unfortunately for the U.S. public, the White House is also publishing easily fact-checked misinformation that confuses the legislation’s aims. Curiously, the misinformation appears to have been drafted by Artificial Intelligence (as the White House has done before). A.I. also appears to be the source of a bizarre video highlighting the TOBBA misinformation with a cartoon of President Trump scooping french fries and throwing them to the ground.

If you, like me, are a citizen of the United States — whatever your political persuasion or ideology — please consider contacting your U.S. Senators about not repeating that unsustainable, “manufactured emergency” process that led to TOBBA’s passage in the U.S. House. If you need inspiration, Senator Ron Johnson (R-WI) said that the House “rushed the process” and “you have to do the work and you need the time to do the work” and that TOBBA*, as written, mortgages the next generation’s future.

* I left out a “B” for beautiful. It’s not.